What could be so hard about managing money, say you, when you only ought to follow the three simple principles – plan, invest and save – is not that right? In the realistic world, however, it takes much more than that.

Most people do not even realize how good or bad they do with managing money flow. While creating a financial plan is a force many individuals and businesses wield, only a few succeed in achieving results. The latter is what makes the difference.

Financial planning has evolved a lot with our spending habits, the nature of investments, and rising inflation rates. It prepares you for any unforeseen events. A sound money management plan can help you save money, grow your wealth, and reap the rewards when you need them the most.

If you are doubtful about why you should make a financial plan and think about your money management tips, look further into this article. We will discuss five money management tips that can work out for you in 2022 and beyond.

Tip 1: Chalk out a Financial Plan

Without a sound financial plan, your money management efforts will fail. Every individual has unique financial needs and goals to achieve. Set out your short-term financial objectives, including covering necessities such as funding your monthly groceries. More importantly, though, make a long-term financial plan considering the following particulars:

- How much money will you need in 20 years?

- Do you have a mortgage? If you do, what is the remaining balance you need to repay?

- Are you looking to make savings for your children’s college tuition?

- What will be your source of income after retirement?

Setting up a realistic and achievable financial plan is your first step toward effective money management.

Tip 2: Set your monthly budget

Make a budget for all monthly expenses, including groceries, utility, and loan installment expenses. Then decide on your strategy toward spending on luxury and necessities, and if you are willing to make cuts. Finally, compare your total costs against your total income.

Once you allocate a portion of your income to a specific goal, stick to it for at least 6 months, when you can revise your budgets and compare your achievements with enough data to support your decisions. If you only allow it, your short-term success will accumulate into a big one.

Tip 3: Save once, Save twice, Save thrice

You will never save a penny if you think you will save whatever is left after your expenses. Set aside a portion of your income as your savings as soon as you have it.

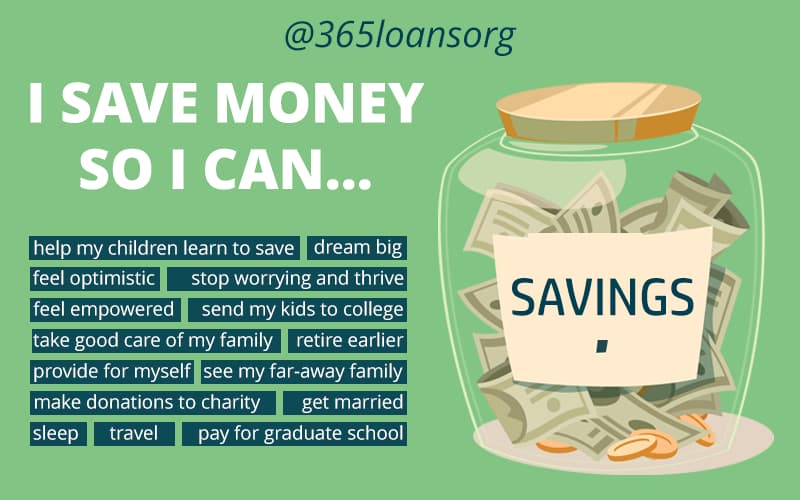

Savings in your account makes you at home when contingencies transpire. You will need to save money for short- and long-term events, such as your coming-up summer vacation plans, house renovation, and children’s education.

Unsubscribe yourself from unnecessary marketing campaigns. Lay off your expenses, and find ways for extra income. Sharing a small portion of your house on the rental market could accumulate a small fortune for you in the long term.

Tip 4: Invest wisely

Depending on how much you have saved over the years, your investment decision will likely affect your money management.

If you have small surplus cash and cannot put it aside for longer, think about bank CDs and Special Savings Accounts. These accounts offer higher interest and are highly liquid investments.

On the other hand, if you have a substantial amount of cash in savings and can hold it for an extended period, consider investing in stocks or bonds. Look for the best long-term investments, such as growth stocks, ETFs, Dividend Stocks, or Retirement funds.

Investing in a good account will not only stockpile your money into wealth for the long term, but also provide you with a buffer of extra income. However, do not put all of your money in one basket. Instead, diversify your investment portfolio and remember the old rule:

Tip 5: Manage your debts

Living with financial debts is an inevitable part of most people’s lives. From credit cards to house mortgages, student loans to business loans, everyone might leverage financing help at some point in life. One thing you can control is selecting the right debt option and managing it carefully.

For example, set a minimum credit card payout that reduces your principal amount quickly. For house mortgages, choose between a fixed rate and adjustable rates wisely. Avoid refinancing unless it is inevitable, as second loans always have higher interest rates. Debt decisions mirror investing decisions: the riskier the loan, the more expensive it gets. Banks and lenders will charge you high-interest rates and attach covenants for your risky loans.

What factors matter for Effective Financial Management?

Successful money management requires strict obedience to your financial plans.

Your money management success is a combined net effect of your planning, savings, investment, and debt management actions. One key point for achieving your financial objectives is regularly revising your financial plans.