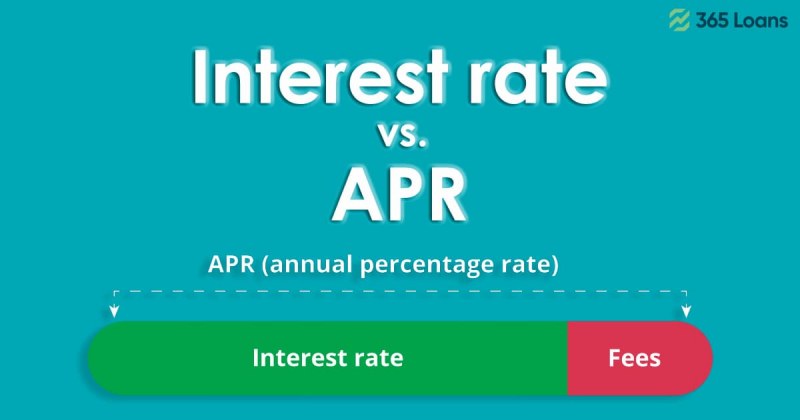

Interest rate and annual percentage rate are concepts commonly used in mortgage, personal, and car loans. Although both might have similarities, one distinctive difference related to their calculation takes them apart.

You may have heard or read how the advertised rate on bank loans differs from what you get when you decide to take the loan. That difference occurs because the advertised rate represents the interest rate, but the actual rate used in the final calculation is the annual percentage rate. Because of these discrepancies, you might find that the loan conditions are not as favorable for you as they seemed at first glance.

It is in your best interest to understand the contrast between the two terms as that will help you avoid confusion about the amount you will end up owing the bank; hence make an informed and intelligent decision.

Read further for a simplified explanation of both.

What is an Interest Rate?

The interest rate is the extra amount banks require for granting you credit. In the typical case, the borrower pays this amount in monthly installments alongside the initial amount they borrowed. Traditionally, banks state the cost of borrowing money as a percentage rate. However, that percentage does not include any fees or other costs associated with the loan.

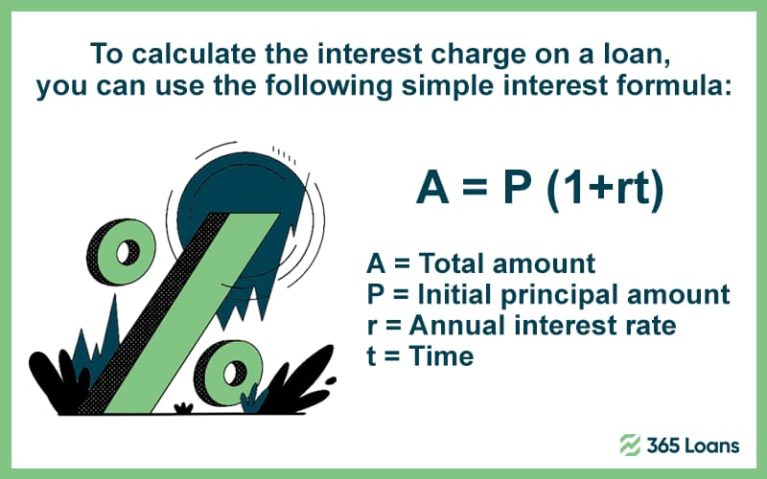

How is the Interest Rate calculated?

In case you are applying for a loan, you can calculate the interest rate according to the following formula:

When you request a loan, you are committing to pay the requested amount plus interest. Therefore, the interest rate remains the same without changing its percentage.

What is an Annual Percentage Rate?

The Annual Percentage Rate, or APR, is the 365-day total reference rate of the interest rate. The purpose of the APR is to help you know your loan’s interest rate, commissions, and extra expenses.

Thanks to this rate, you can obtain specific details such as the total amount for the credit financing you will request. Ultimately, leading you to a position where you will confidently decide which is the most convenient according to your needs.

Another essential aspect that we must mention is that there are:

- a fixed APR; and

- a variable APR.

If you get a loan with a fixed annual percentage rate, the money generated will not change. However, if you go with a loan with a variable APR, the percentage might change, hence the amount of money it generates in revenue for the bank.

How is the Annual Percentage Rate calculated?

To calculate the annual percentage rate (APR), you will need to do the following formula:

APR = Amount to request x Extra commissions x Interest rate x Payment term

For example: €20,000 x €2,000 x 5% x 20 years = 6.164%

What is the difference between the Interest Rate and the Annual Percentage Rate?

Any misunderstanding of the interest and the annual percentage rates might lead you anywhere from simple confusion to a financial loss. Therefore, ensure you are fully aware of the given conditions and specific conditions you need to be observant of when evaluating loan choices.

- Be cautious when comparing the APRs of fixed-rate loans to the APRs of adjustable-rate loans, or the APRs of multiple adjustable-rate loans.

- Exert caution when comparing the APRs of adjustable-rate mortgage loans. The APR for adjustable-rate mortgages does not reflect the loan’s maximum interest rate.

- Be wary when comparing the APR of a closed-end loan that contains fees to the APR of a home equity line of credit that does not. When selecting which loan is best for your situation, don’t only look at the APR.

The interest rate gives you the annual percentage of interest on the credit you plan to request. The annual percentage rate adds the nominal interest rate, commissions, and extra fees to the initial amount of money. Due to these differences, you should always check the annual percentage rate, not only the interest rate. Calculate the rates and explore other options prior to getting any loan to choose the best one for you.