How would you like your 60-year-old self to be incredibly proud and impressed by your 20-year-old self for internalizing all the fantastic information on saving, executing them, and setting you for life?

You do not want yourself sitting on your couch, regretting how you could have used your 20s so much better.

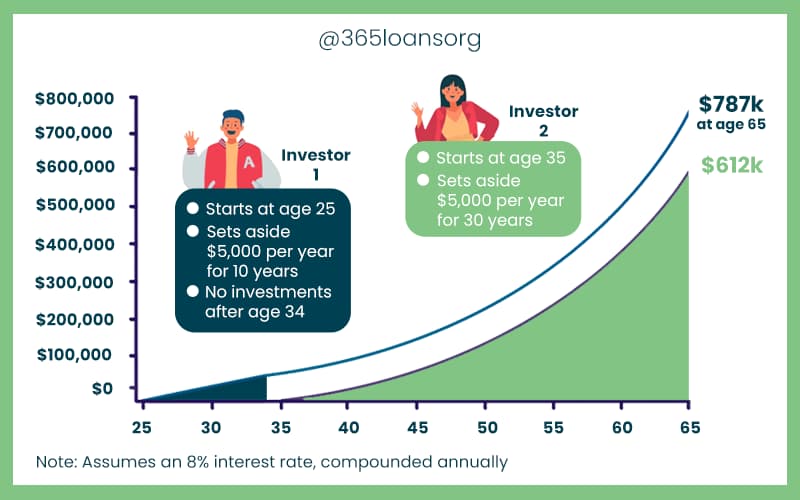

To be more confident about your 40s and 50s, you need to have a solid head start in your 20s. The earlier you start saving your money, the higher your savings rate will get over time, and the more powerful, luxurious, and worthwhile your retirement will be. To acquire financial independence, you must enjoy the journey that brings you there. You need to know the process, do it step by step, and even make mistakes on your way as you head towards your goal.

If you are still not convinced, we have a few points for you to go through to understand why it is essential to start saving in your 20s:

Financial Security

The sooner you start saving your money, the better. Why? Because the investment you make during the initial stages of your life will have plenty of time to grow. You will be able to earn a lot of money through them, which you can later invest and carry on the cycle. Your added layers of investments save you from worrying about money when you no longer have any stable means of earning it. This is when you hit the stage of achieving financial security.

Initially, it will not seem easy to accomplish something ambitious like this, but the goal is to start planning. It would help if you established a financial motive, collected all the resources that can accelerate the process, and have clarity around your funds, investments, and various other income sources.

There are so many pros to being financially secure that they can easily outweigh any disruptions that you may meet at the start. Mend and customize your goals according to your comfort. Then, when you have a goal to hit, you will actively work towards it. And at this time, starting to save your money when you are 20 does not sound like a wrong goal to have, does it?

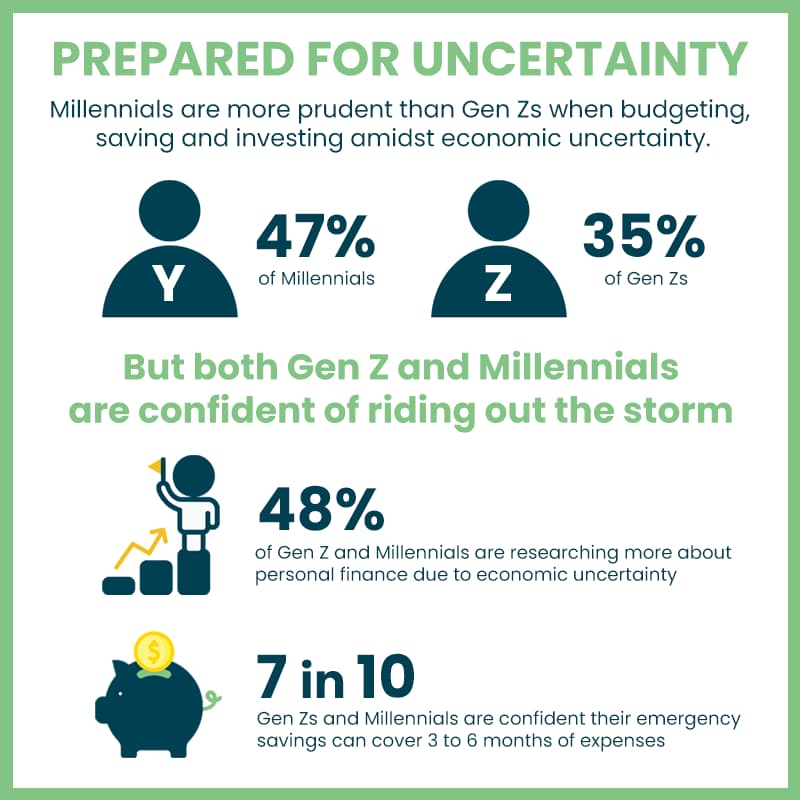

Sudden Emergencies

Imagine you are in your late 40s. You wake up to an emergency where your family member is suddenly very sick and needs substantial money for treatment and medical purposes. You walk up to your bank, and there is not a single penny for you to put in for their need. Careless and wasteful spending in your 20s does not seem like a sage and worthwhile thing to do, does it?

How about we tell you that you can avoid being in this situation only if you have a concrete plan today?

You have to make sensible decisions in your 20s that effectively have long-term, positive effects on your life. Here are some quick tips to help you on your journey:

- Do not just stick with the same amount; you need to diversify and increase your investments when your income grows.

- Manage your spending habits smartly.

- For a long-term plan, you need to have small milestones.

- If you think reading a book on financial development will help you, do that.

- If you consider reaching out to people to clarify your doubts on the facets of investment that will help you, do that.

Do whatever will make you move in the right direction. If you have a stable financial strategy, you will likely deal better with emergencies and contingencies.

Early Retirement

Your retirement is not a long way off. Especially if you want to retire early and be financially independent. The only factors that can come between you and your desire to retire early are your lack of commitment to your work, poor-decision making skills, imprudent expenditure, and the absence of sufficient savings. The 20s is probably the best period of your life when you can start planning your future and work ways to establish a retirement fund as early as possible.

Through a set of conscious decisions, you will be able to have control over when you want to retire. Think of all the traveling you will be able to do, spending your time whichever way you want to, doing whatever your heart desires, without troubling yourself thinking about money. If you can foresee the lifestyle you want when you retire, you need to work hard and be smart about it.

Saving can be pretty challenging, especially if you are surrounded by people who are extravagant spenders. However, if there is a hidden spendthrift in you that is unleashed at uncertain times, you should become best friends with compounding. This process will help you further your interest in investing and savings and will potentially help you cherish the fruits of early retirement.

Final Words

You do not want to be an old, grumpy, 60-year-old trying to figure out their life, unable to shake off the feeling of remorse of not having saved any money in their 20s.

Your 60s are not the time when you struggle to get yourself out of debt while you beat yourself up for all the money that you foolishly spent when you were young and thriving. You are here for a good time, not a very long time. So, how about you make the most of it? Start planning at the early stages of your life, seriously consider the option of saving, get a little smarter at handling your finances, and get a steady move on.