The issue with the FIRE movement is that marketers and money grinders take something excellent, give it a fashionable name, and then go too far with it. In a word, it is a movement rather than a systematic approach to money management. But care to stay for a little more than that.

If you tell a 20-something to invest 10-15% of their income in an IRA or a 401(k) and that, if they work for 30–40 years, they might be able to retire “early” in their 50s, you cannot sell them financial independence and early retirement plan. Simply said, that doesn’t sound very enticing.

What makes the FIRE movement faulty in every way?

In a way, the FIRE movement is comparable to real estate scams like the “BRRRR Investment Kits,” and they are schemes, indeed, so let us just admit it.

On its own, the Buy, Rehab, Rent, and Repeat (BRRR) is a suitable investment method. But there are online yahoos who try to make a living by selling dubious knowledge combined with impossible-to-meet promises of near-future success. That they call “investment kits.”

Along similar lines is the FIRE lifestyle. Yes, you may retire early and achieve financial independence. You do not, however, need to purchase a “FIRE kit,” read a FIRE book, go to a FIRE course, or spend your entire life online in FIRE discussion forums.

So, instead of sharing the hard-to-accept truth, some “Financial Kung-Fus” assert that you could save 70% of your $100,000 salary and retire by 40 or even at 30. They make this promise on the grounds that you can survive on a tiny sum of money. There have been extreme cases in the community of people claiming to live with $7000 a year. While not impossible, it is safe to say that even homeless people in countries like the USA have an income higher than that.

But even worse, these programs, tools, and books set people up for failure. It is not about the concept but about the sellout of that concept. Like an MLM scheme, this sort of “life coaching” was never tested to work, if even designed to do so.

Thus the average person who spends $49.95 to sign up for it cannot make it work. The gruesome part is that the victim later starts to believe they failed because they were not good enough. So be it not good enough at flipping houses, vehicles, BRRRRs, FIREs, MLMs, or whatever – they further sink into depression, which is what initially drew them to these con artists for many of the cases.

That being said, there will be people who find peace with the FIRE movement. The general concept is about being frugal and saving money, which is excellent. But the fake stories and the omitted truths around the idea corrupt it.

Why the FIRE movement is not an all-valid truth?

If you want to know why the FIRE movement is not a legitimate way of life for everybody and the hefty price it comes with, read further in the following sections.

- The FIRE movement goes down to money only

Although necessary, money is not everything. The FIRE movement is very concerned with finances and saving and will advise you to reduce expenses as much as possible to increase your savings.

The initial thrill of seeing money grow in your savings account is pleasant. Unfortunately, it eventually becomes a burden. To put more money in your savings account, you will have to say “no” to many of the things you enjoy doing.

Saving exclusively for future early retirement is unhealthy. Instead, begin saving for various objectives. For example, save money for a new car, your upcoming vacation, and other pursuits while saving for retirement. Saving money for nothing but the sake of saving is pointless and unfulfilling. If there is no clear purpose behind it, saving money and carrying the load of the future will wear you out.

- Upgrades to one’s way of life are not permitted

Only if you want to “survive” for the rest of your life does FIRE work. This way of life is not for you if you are ambitious and constantly striving for more.

To retire early, the FIRE movement advises saving 25 times your annual costs. For instance, you would need to have saved $750,000 if you needed $30,000 every year. However, the trade-off is that you are confined to this way of living for the rest of your life.

You might also want to check out: How spending money can make you happy and rich, if done right

The movement ignores the fact that people frequently upgrade their lifestyles. Therefore, to maximize your savings and retire early, the FIRE movement advises you to suffer now for a better future. If one comes.

- FIRE proponents fail to disclose their true source of funding

The bulk of the FIRE movement blogs and influencers advocate books on FIRE movement topics and various informational sources that teach about the subject. Yet, many choose not to disclose their true source of income and do not include their side earnings – such as from the very same YouTube channels or blogs – in their calculations of income. This raises specific questions about at least part of that community.

If you are pushing “your” FIRE lifestyle and asking people to join the cult, shouldn’t you be at least a bit upfront and come clear about where your income comes from?

The problem with the FIRE

Are all the books, materials, and advocates, like the ones in the example above, frauds? Maybe not. Maybe some of them teach how to save wisely, how to reduce excessive spending, and how to retire early on a lower but adequate salary.

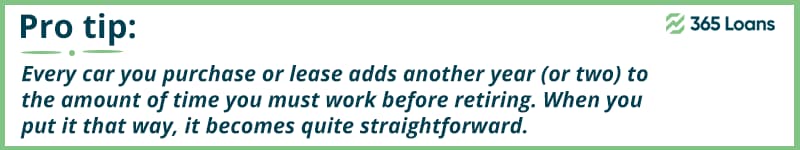

But the truth is that the “system” can be encapsulated in two words – common sense. That’s all there is to it. You have two options in life:

- invest your money; or

- spend it all on a brand-new fancy belonging, such as a car.

And you do not have to pay anything to understand this!