Being a homeowner carries a lot of responsibility. You are taking care of your biggest financial asset, which is your house and yard. But most of the time, we don’t consider it that way. Until an accident occurs, that is.

What if someone slips and falls on your steps or trips over a rug? Are you ready to handle the financial fallout from a lawsuit? You can use a personal umbrella policy in this situation.

If an accident occurs on your property, it may be able to prevent you from becoming bankrupt. Read on to find out how.

What are Umbrella Insurance Policies?

An umbrella policy represents an additional layer of liability protection that can stop a lawsuit from destroying both your current wealth and any potential future earnings.

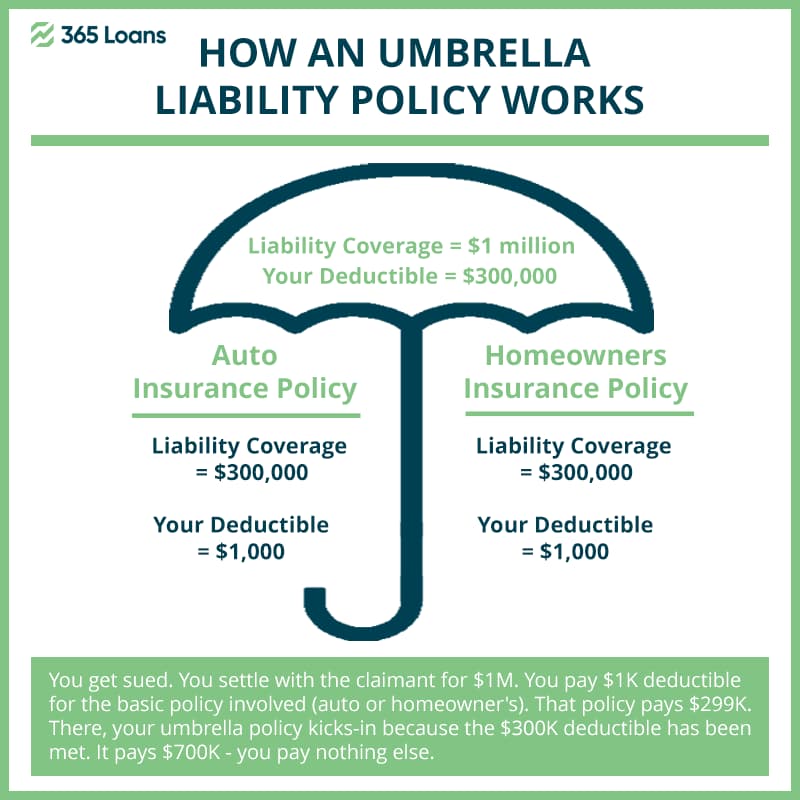

You might think of umbrella insurance, also known as excess liability insurance, as a promise that would protect your savings, income, and other assets at all costs. Therefore, if you are sued for losses more than the liability limitations of your homeowners’ insurance, an umbrella policy will pay the balance of your debt. The extra protection allows you to reduce the risk of being saddled with years of debt in case of lawsuits.

When considering purchasing an umbrella policy, keep the following information in mind.

How an Umbrella Policy protects you?

Here are some illustrations of the different sorts of coverages offered by umbrella policies and how they safeguard homeowners:

Liability for Physical Injury

This takes care of the expense of harm to another person’s body, including the cost of medical expenses and liability claims as a result of:

- A visitor to your home hurt badly after sliding down the stairs.

- A neighbor’s kid hurting themselves on a trampoline in your backyard.

- Your dog bites a stranger who is stumbling around in your backyard.

Damage to Property Liability

This covers the expense of destroying or losing someone else’s tangible property, including the costs of the following circumstances are some examples:

- Claims for damages made when your puppy tears a friend’s treasured possessions.

- Accidental harm your child does to school property.

Rental Property Owners’ Liability

This shields you from legal responsibility as a landlord, including costs associated with liability lawsuits resulting from:

- Someone falling on your rental property’s snow-covered patio steps and suing you for damages.

- You are held accountable for someone getting hurt by your tenant’s dog.

What are the Pros and Cons of an Umbrella Liability Policy?

Should you consider purchasing umbrella insurance for your family, business, or even yourself? Here is a summary of the advantages and disadvantages of umbrella insurance, so you can decide what is best for you.

Advantages of an Umbrella Coverage

- After the limits of their home insurance policies have been reached, it offers homeowners additional liability protection and financial assistance with a legal defense.

- It covers instances like wrongful arrest or malicious prosecution that your primary insurance may not.

- The minimum coverage limits are $1 million.

- Generally speaking, umbrella coverage is applicable everywhere.

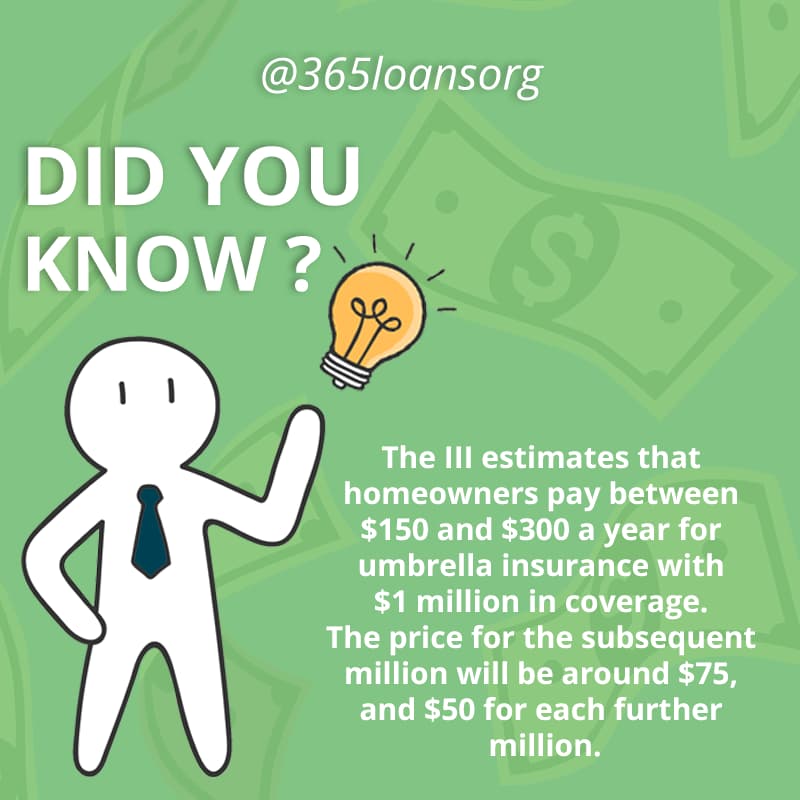

- Affordable cost when compared to the scope of the coverage.

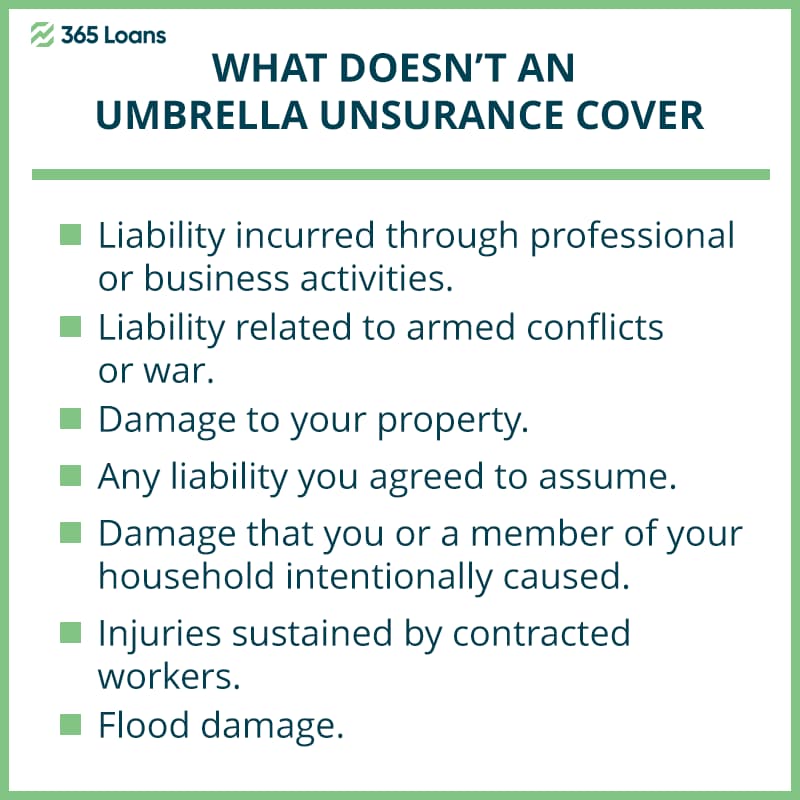

Disadvantages of an Umbrella Insurance

- To be eligible for an umbrella policy, homeowners must already have homeowners or property insurance.

- Before adding umbrella insurance, homeowners must acquire the bare minimum of home insurance liability coverage.

How much should your umbrella policy cover in terms of money?

Umbrella insurance is often sold by insurers in portions of $1 million. Therefore, the cheapest policy offers up to $1 million in coverage, followed by $2 million in coverage. Purchase the amount necessary to cover your net worth. Include future prospective income in your estimate if you expect to earn additional money soon.

Most major insurance providers offer umbrella insurance but keep in mind that most of them also demand that you have home insurance with them. Yet, do not be reluctant to shop for prices, as some firms still sell a standalone umbrella policy, which would allow you to carry your home insurance with a different company.

The highest limit a corporation can offer is another factor to take into account. Although some can go higher, most umbrella insurance policies have a $5 million cap. You should look for a business that can equal your net worth if it exceeds $5 million. Remember that greater limitations can mean higher premiums.

Should you consider an umbrella policy?

Only when you weigh the cost of an umbrella policy against the value of your possessions and the potential for expensive insurance claims can you decide that the extra protection and peace of mind are worth the trade-off.

Overall, umbrella insurance offers exceptional value for the money and gives homeowners peace of mind knowing they can maintain a prosperous financial future if an accident occurs. Especially in light of the increased peace of mind that comes with being a homeowner or landlord.

Additionally, your umbrella insurance will not require a separate deductible payment. Plus, you can also speak with your insurance agent to take advantage of bundling your insurance plans for a discount.