The warning indicators suggest the US economy is now probably in a technical recession, even if many economists continue to avoid using the R-word. Despite four interest rate increases from the Federal Reserve, consumer confidence has decreased, the stock market is in the bear market territory, and inflation is continuing on the rise, in addition to another quarterly decline in GDP, or gross domestic product.

Since many businesses, particularly in the tech industry, have announced layoffs recently, a rise in layoffs—another vital sign of a recession—is also being felt nationwide. And if you ask most folks, they’ll tell you that it’s grown unquestionably more challenging to get by. The majority of Americans, or 58%, believe we are in a recession, according to at least one June poll. Others, however, highlight several essential indicators that indicate the opposite direction, such as low unemployment rates, increased consumption, and a robust banking industry.

Although the National Bureau of Economic Research, which has stayed silent thus far, makes the official determination of whether a recession has occurred, it seems very arbitrary to categorize this difficult financial era as a recession or not.

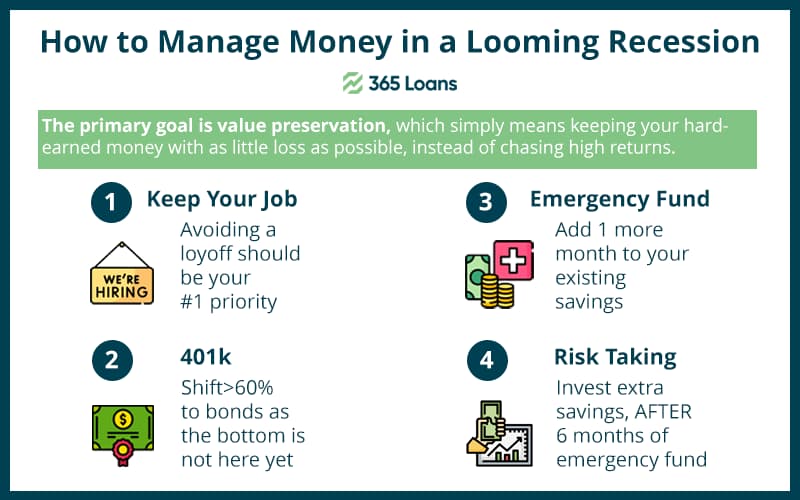

Here are eight concrete actions you can take in a volatile environment to increase your financial stability and resilience.

Step 1: Plan more and worry less

The good news about the current recession estimates is that they are still merely predictions. Without the actual pressures and difficulties that come with being in the midst of an economic slowdown, there is time to put together a plan. Review your financial strategy over the coming months and create some worst-case scenarios when your adrenaline isn’t pumping.

Some issues to think about are:

- What would you do if you lost your work later this year or at the beginning of 2023?

- How can your finances be strengthened right away to withstand a layoff?

The simplest of all answers is to…

Step 2: Increase your cash on hand

Having money in the bank is essential for making it through a recession largely undamaged. This was demonstrated by the Great Recession’s high unemployment rate of 10% in 2009. For those who were impacted, it took an average of eight to nine months to get back on their feet. Those who were lucky enough to have sizeable emergency funds were able to cover their housing expenses and buy some time while making less stressful decisions on what to do next.

To come closer to the advised six to nine-month rainy day reserve, you might want to restructure your budget to dedicate more money to save right away. Unplugging from monthly subscriptions may make sense, but calling billers (from utility providers to cable companies to car insurance) and asking for discounts and promotions may be a better plan that won’t feel as depriving. Speak with client retention specialists, in particular, to learn what incentives they might provide to prevent you from canceling your plans.

Step 3: Find a second source of income

Web searches for “side hustles” are common at all times, but now more than ever as people attempt to diversify their sources of income in preparation for a future recession. Diversifying income streams can lessen the income unpredictability that comes with job loss, just as it helps to diversify investments.

Check out our ideas for quick, low-effort side gigs you might be able to perform from home.

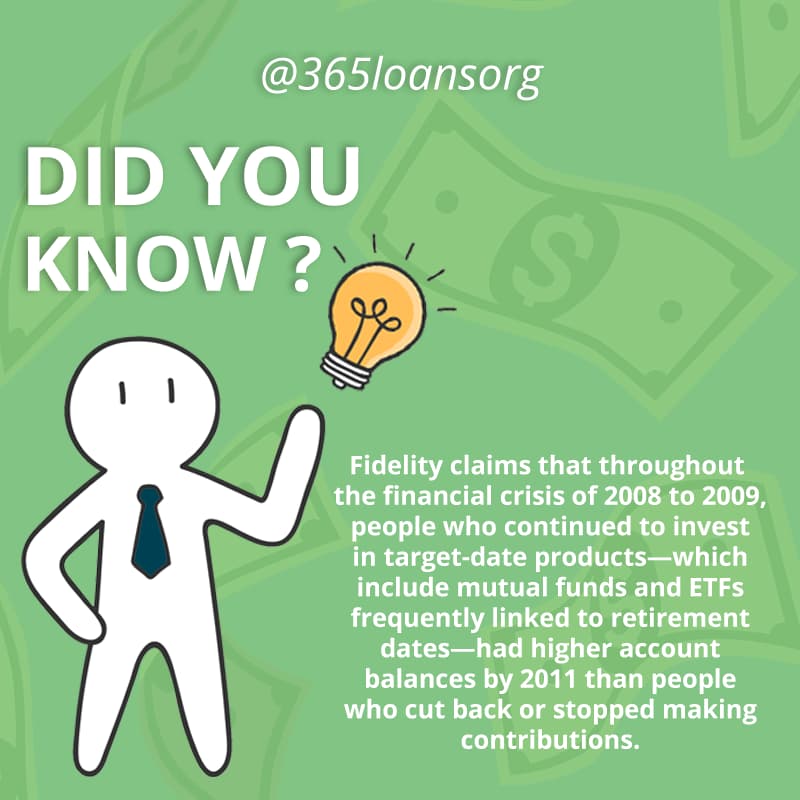

Step 4: Avoid making rash investment decisions

After all the stock market warning signs this year, it can be difficult to resist having concerns about your portfolio. History demonstrates that it is better to ride out the market’s ups and downs if you have more than 10 or 15 years till retirement.

Look into automated rebalancing with your portfolio manager or online broker if you haven’t already done so. Despite market fluctuations, this function can make sure that your instruments are still moderately weighted and in line with your risk tolerance and investment objectives.

Step 5: Reconsider buying a house

Even while home prices have decreased in some locations, there are still not enough homes for everyone, making the housing market competitive. Consider renting for a short while longer if rising mortgage rates are making it harder for you to purchase a property within your price range. Even more of a cause to stop if you’re concerned about losing your job in the event of a recession.

Currently, leasing isn’t inexpensive, but it can give you greater mobility and flexibility. Renting can also make you more liquid amid a potentially unstable economic climate, as you won’t need to set aside money for a down payment and closing costs.

Step 6: If it ain’t broke, don’t fix it

If there is one thing that you can take as a lesson from the late 1970s period of extremely high inflation, that will be to protect your valuables.

Due to persistent supply chain problems, many of us must pay exorbitant costs and wait a long time to get new cars, electronics, furniture, household goods, and even contact lenses. This also applies to spare components.

Step 7: Consider locking your interest rates

Interest rates will rise as a result of policymakers’ attempts to combat inflation. Anyone with an adjustable-rate loan could face unpleasant news as a result of this. People who have a balance on their credit cards might find it difficult as well.

Borrowers of private variable-rate student loans may want to look into debt consolidation or refinancing options through an existing lender or other banks, such as SoFi, that could consolidate the debt into one fixed-rate loan, even though federal student loan borrowers don’t have to worry about their rates rising.

Step 8: Safeguard your credit rating

As interest rates rise and banks impose stricter lending guidelines during recessions, borrowers may find it more difficult to acquire credit. You should strive for an excellent credit score in the 700s or above to be eligible for the best loan terms and prices.

Your current bank or lender should be able to provide you with a free credit score check, and AnnualCreditReport.com offers free weekly credit reports from all three major credit agencies until the end of the year.