Reaching a point where you are beginning to think about buying a house represents a significant turning point in almost anyone’s life. In many cases, you will at least consider affording the purchase with financial aid from either an adjustable or fixed-rate mortgage.

If you have been a homeowner before, you are undoubtedly familiar with the several kinds of mortgages that banks and credit unions provide. However, getting on par with the intricacies of mortgages might be overwhelming, regardless if this is your first or one more time purchasing a property.

Therefore, in order to better assist your decision, we would like to address a frequent question:

Is a fixed-rate or adjustable-rate mortgage better?

Understanding Mortgage Terms and Rates

Prior to discussing the technicalities of fixed-rate and adjustable-rate mortgages, it is critical to comprehend how a mortgage is actually repaid. Any mortgage payment consists of two components:

- principle (the loan’s face value); and

- interest.

The amount you pay is determined by how long your mortgage is. The most typical and well-liked loan terms include 15-, 20-, or 30-year repayment schedules. Furthermore, 30-year mortgages are particularly well-liked due to the lower monthly payments.

A Fixed-Rate Mortgage: How does it work?

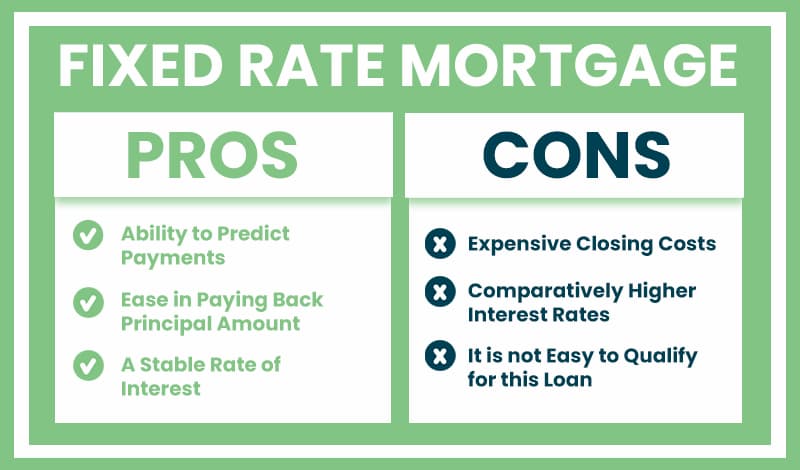

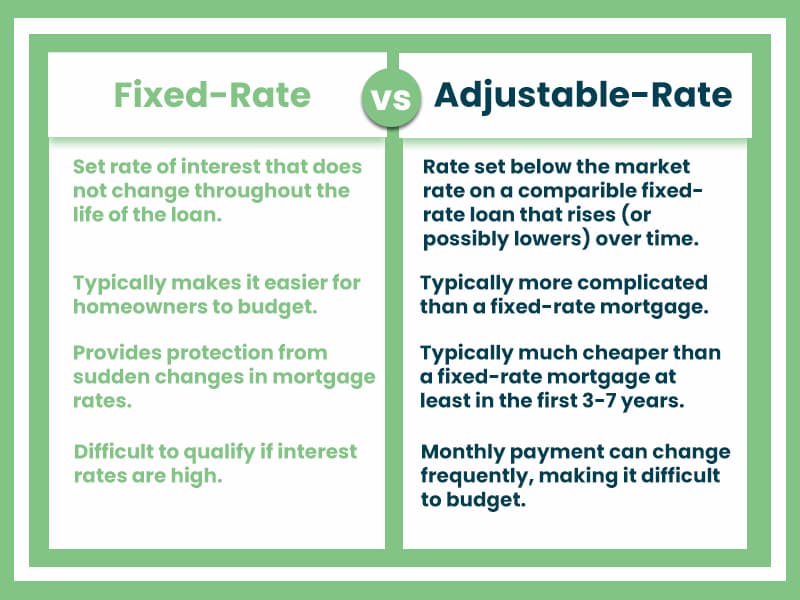

An interest rate on a fixed-rate mortgage is precisely what it sounds like: fixed at the time the loan documents are signed. Over the course of the loan, you are aware of the exact amount you must pay each month.

However, you should also consider that if you lock in a high-interest mortgage, even if the rates fall later, yours will not. That could result in hefty monthly installments.

Adjustable Rate Mortgage: How does it work?

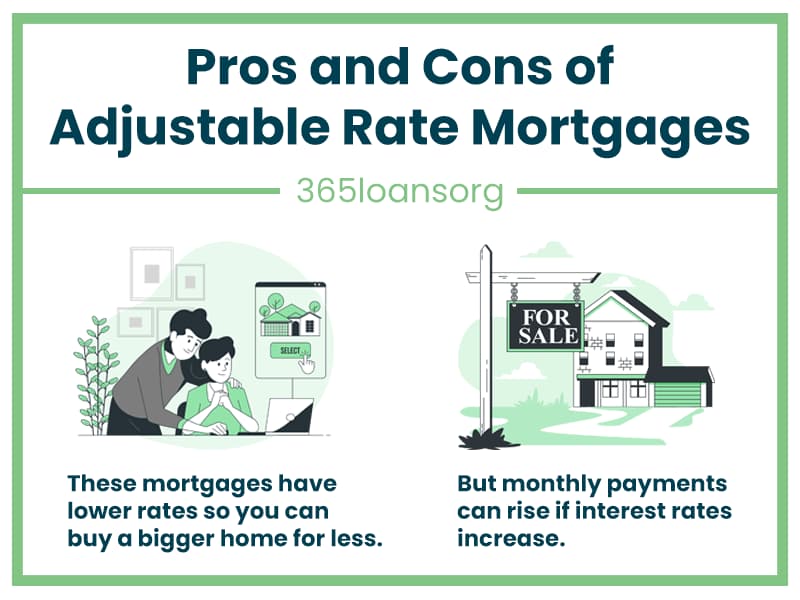

A mortgage with an adjustable interest rate (ARM) provides a variable interest rate throughout the life of the loan. When you sign an ARM, the initial years of repayment are often provided at a cheaper rate than the fixed-rate equivalent. However, the ARM will start fluctuating after that first predetermined amount of time. Typically, these variations are linked to certain indices, such as the Federal Prime Rate or the London Inter-Bank Offered Rate (LIBOR).

The advantage of an ARM is that the interest rates are typically lower than those of a fixed-rate mortgage, especially in the short term. Moreover, this reduced rate may last for extended lengths of time if the calculating index experiences a slump, as it did, for example, in the period immediately following the financial crisis of 2008. If so, your total payment might be significantly less than it would be with a fixed-rate mortgage.

The drawback of an ARM, on the other side, is that it is more challenging to plan for in the long run. Additionally, if interest rates rise, the interest rate on an ARM may be higher than the rate on a fixed-rate mortgage.

Should You Pick an Adjustable or Fixed-Rate Mortgage?

In general, adjustable-rate mortgages are easier on your wallet in the short term, but fixed-rate mortgages are typically more cost-effective over the long run. To adopt the answer to this question to your case, you should thoroughly analyze your financial situation and the circumstances of your mortgage search.

Yet, if you find yourself in any of the following situations, an ARM may be more advantageous than a fixed-rate mortgage:

- Do you anticipate swiftly paying the debt?

An ARM will save you money if you think you will be able to pay off the principal in full before the rates rise too much. That means less than 10 years. An ARM is also a wise choice, for instance, if you are planning to buy a new house right after selling your current one but will not have the money until the sale is through.

- Do you anticipate an increase in your income?

An ARM might be a perfect choice for persons like business, medical, or law students who may currently make less money but anticipate making a lot more money soon. The early, smaller monthly payments will be simpler to manage, but the latter, greater payments will make sense, given the increased income levels.

- Do you plan to own the house for a short period only?

An ARM can be advantageous for you if you are moving to a new city for education or work and intend for your purchase to be a temporary residence. Then, you will only have had to deal with an ARM’s lower rates when you leave and sell the home.

These are just a few situations where an adjustable-rate mortgage is the better option. However, a fixed-rate mortgage can be preferable to an adjustable-rate one if you want to stay in the house for the long term and do not anticipate a sudden infusion of cash.