Accruing debt is quick and easy. Leaving debt behind is something that takes a real hit on your will and energy. There are examples of people who were able to get out of debt quickly, but for the average person, it will usually take several long months or even years of steady work.

You can get into a lot of debt in one day, a few weeks, or a few months. But it takes a lot more time and work to get out of debt. The reason for this is that most people spend everything they make, if not more. But perhaps you need a new perspective.

How Much of Your Life Do You Want to Spend Paying Off Debts?

You must have heard or seen about people who paid off all their debts, just to climb back right into new ones. They did what? They did not change the way they handled money. Instead, they did the same things over and over again – spending more than they can afford.

Suppose you make $30 an hour and get $45,000 in debt in 3 months. If you worked non-stop for 37.5 weeks without putting any money toward anything else, you would eventually pay off your debt, including taxes. But for the majority of folks, that is not possible.

Since you have utility bills and taxes to pay, it is much more realistic to put about 20% of your income toward your debt. So, if you make about $1,200 a week, it would take you about 187.5 weeks (3.6 years) to pay off that $45K in debt, if you do not get into another meanwhile.

But guess what most people do right after they pay off their debts? They jump right back in.

To Stay Out Of Debt, Do This 1 Thing Instead

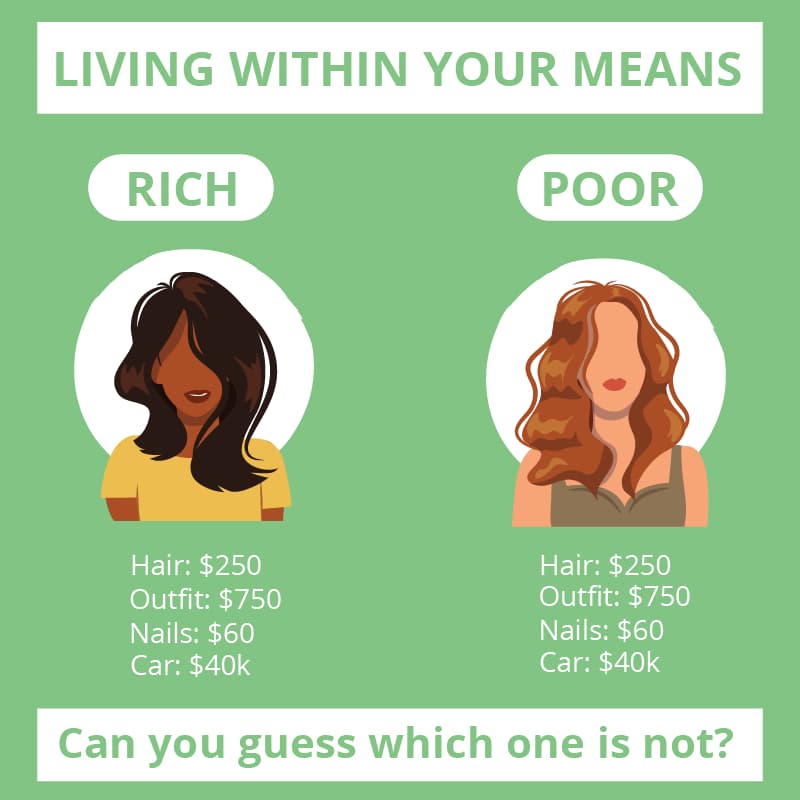

Consistently, millions of people worldwide are forced to spend more than they earn. If you do not want to be a debt slave for the rest of your life, you have to learn to live within your means. In fact, this is your only option. Although requiring extreme self-control due to the abundance of tempting buying possibilities, living a debt-free life is possible.

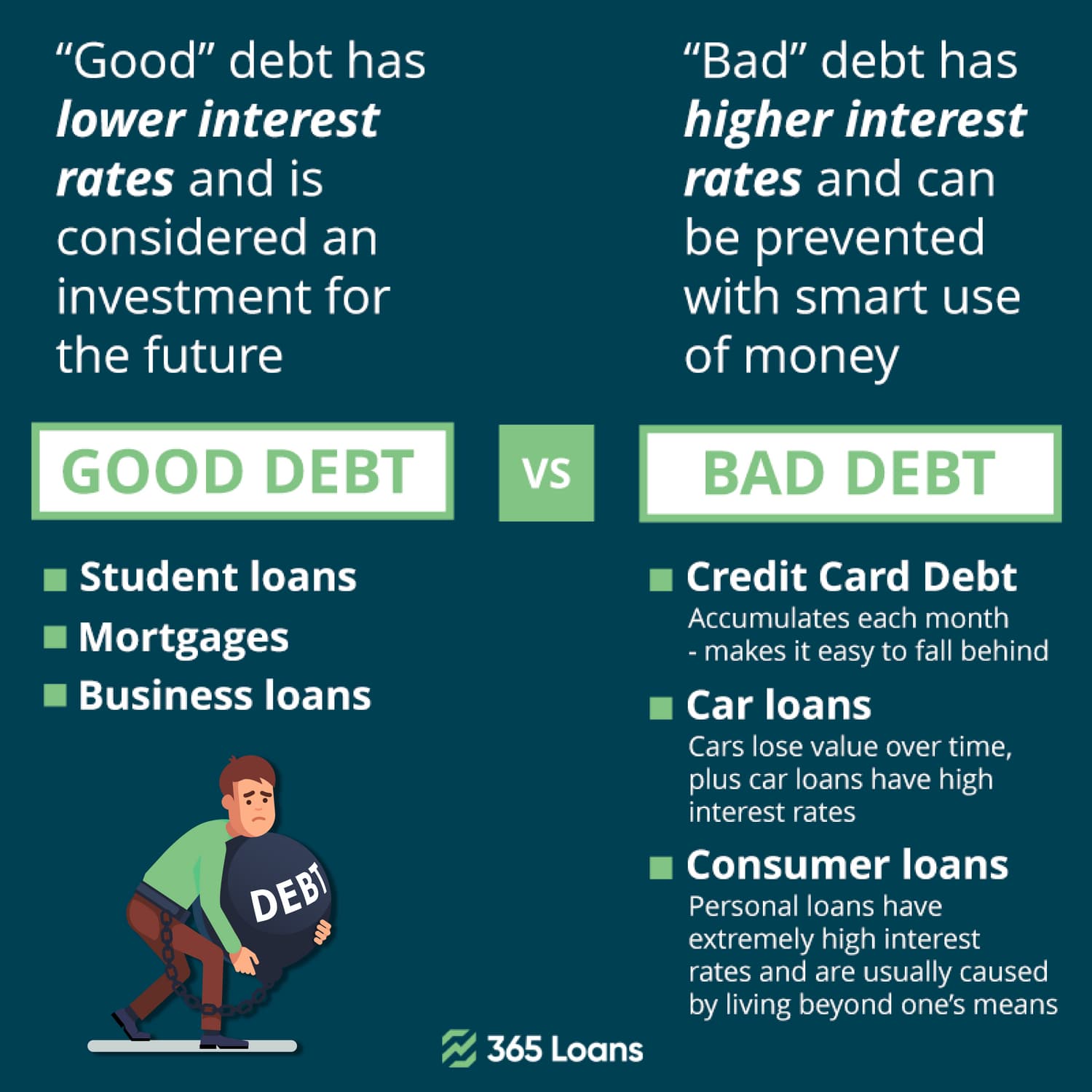

Although some people can successfully leverage their debt, the vast majority of us cannot; our debts control us, rather than us controlling them. The sooner you learn how to turn things the other way around, the better it is for you. Take Robert T. Kiyosaki, for example, who has mastered debt – without moving a finger, he amortized his credit card debt by purchasing many properties, either by selling them at a profit or renting them out to tenants. That’s the right approach!