Businesses and individuals all apply for finances from banks. Bank loan approvals depend on many factors, such as the applicant’s credit score, credit history, income stream, and collateral. Individuals, in particular, find it challenging to acquire the bank credit facility, as they run out of income streams or do not have an asset to present as collateral. Non-bank financial institutes or companies offer alternative financing options. Individuals can also opt for many other alternatives, such as turning to friends and family, government grants, or peer-to-peer lending.

What is Peer-to-Peer lending?

Of course, the first question to ask is, “What exactly is peer-to-peer lending?” In general, it refers to an online marketplace where investors looking for lucrative returns can finance loans to people and, increasingly, start-ups and established businesses. Today’s most well-known peer-to-peer lending platforms provide a financial alternative that can be advantageous to all parties involved, driven by significant technological advancements and the Internet’s global reach.

Peer-to-peer lending, or “P2P,” presents an attractive opportunity for investors to diversify portfolios and improve long-term performance. Through peer-to-peer platforms, they can profit from an asset class that has proven successful in both prosperous and challenging times. They can also avoid the hazards of placing all of their eggs in one basket, which is crucial at a time when many experts think that traditional investments like stocks and bonds are more dangerous than ever.

Platforms have transformed their service-focused ideals into an exciting and potent reality because of significant technological advancements and the internet’s worldwide reach. Signing up and participating at the top P2P platforms often only takes a few minutes and a few clicks or touches, depending on whether you are using a computer or a phone. This is ideal for the fast-paced world of today.

How does Peer-to-Peer lending work?

Non-bank financial companies set up an online platform inviting investors and borrowers to meet their needs. Sometimes they put up initial investments for lending to get things started. Lending at these platforms comes with higher than standard interest rates. Borrowers are looking for alternative finance options or looking for some quick cash sign-up for these high-interest rate loans.

Higher than market interest rates with additional charges allow the margin for both investors and the facilitator. Bank restrictions and lack of income streams make individual borrowing tougher with banking channels. With the dire need for quick cash and sometimes a large sum to settle a bank loan such as credit card payment, it is not unusual to find individual borrowers. On the other hand, wealthy investors or anyone with surplus cash would want to invest in a high-rate investment.

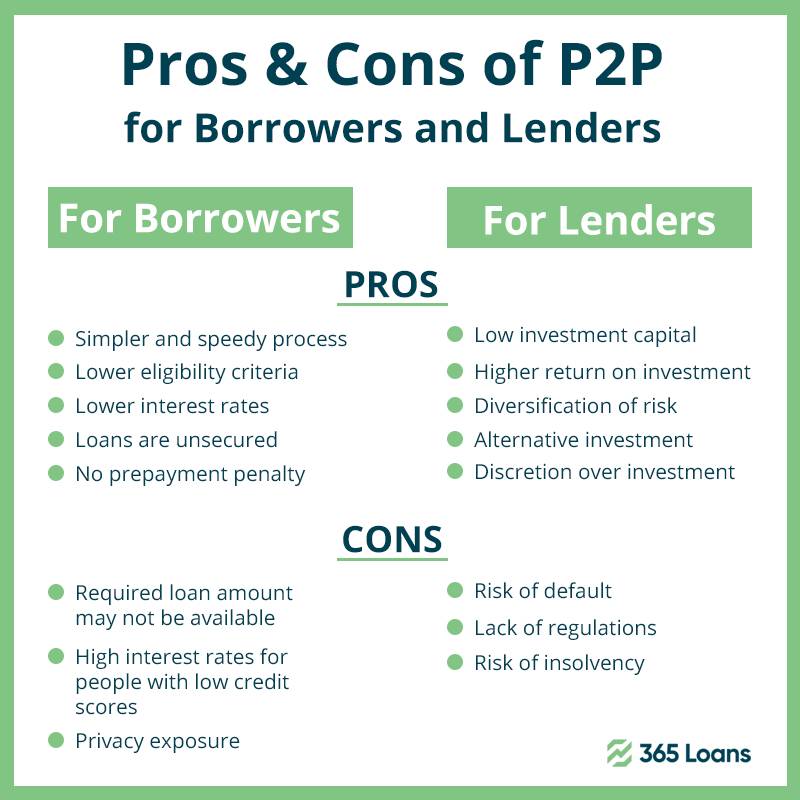

For the facilitator or the non-bank financial company, it is a business venture; for them, all the risks are the same as for any business. However, from an investor and borrower’s perspective, there are a few risks usually higher than with regular banking or investment channel:

- Investors may face high default rates, as most individuals turning to unsecured loans are those without any collateral.

- Investors’ returns are not guaranteed as the investment funds are not secured like T-bills or bank certificates of deposits.

- Early loan settlement arrangements can lower investors expected returns and profits.

- Borrowers have to pay a very high-interest rate on such unsecured loans.

- Borrowers’ risk of default increases as they pay higher interest rates

- Borrowers may lose any asset if they apply for the first loan with a bank and alternative loan with P2P lending platforms.

- The risk of the facilitator company, i.e., the P2P lending platform going bankrupt remains the same for both borrower and investor.

Investors looking for high profits should also consider the tax implications. Higher returns are taxable income at a higher tax rate. Any long-term investments will also have tax implications on capital gains realization. Setting up a non-bank finance company like a P2P lending network has all the same legal procedures that apply to other financial advisory or investment funds.

What distinguishes Peer-to-Peer financing from other types of loans?

Peer-to-peer lending has received much attention recently, partly because it provides a cutting-edge method of bringing together borrowers and lenders. But there is more to it, just like other advanced commercial strategies. People might ask, for instance, what makes peer-to-peer lending so different from dealing with a bank – or, perhaps, why it is so much better – or why it has gained popularity in so many regions of the world.

Undoubtedly, the sector has experienced significant expansion in recent years. According to Business Insider, the world’s two largest P2P markets, the U.S. and Europe, have seen transaction volumes grow at double and, in some cases, triple-digit percentage rates thanks to a legal climate that is friendly to online commerce and widespread acceptance of it.

The financial industry has recently introduced numerous cutting-edge goods and services. Famous examples include Bitcoin and other “cryptocurrencies,” which many see as a replacement for conventional currencies, digital payment services, which make paying bills and sending money to loved ones much more straightforward than in the past, and online financial portals, which let users access and monitor their bank and other accounts from a single location.

Few of these advances, meanwhile, have managed to disrupt the game the way peer-to-peer lending has. Nevertheless, P2P lending, which connects people who want to lend money to others who wish to make more on their money, has emerged as a common financial tool in less than ten years. Transparency Market Research projects that the global peer-to-peer market will expand at a compound annual rate of nearly 50% through 2024.

Peer-to-peer lending improves your investment portfolio

There is a lot to be stated for the advantages of diversification, even if this were not the case. Long ago, academic academics and financial experts realized that spreading risk across various asset classes, including those that may produce steady income, was one of the keys to long-term investing success. Simply put, when you invest in a peer-to-peer network, you increase the upside potential of your entire portfolio and your exposure to an investment that has performed well over time.

The advantages do not, however, only accrue to one party. Online marketplaces have made it possible for borrowers – who historically have been individuals, although this is quickly changing as corporations begin to benefit from P2P – to access financing when they could not do so through conventional channels. In several nations around the world, banks and other intermediaries have failed to or are reluctant to lend to specific categories of borrowers, even those generally seen as creditworthy, due to increased regulation and risk aversion.

Investing in P2P makes money work for you – fast and effortlessly

The next step is to submit the relevant information, such as how much you want to invest and the strategy you like, which can be as hands-on or hands-off as you prefer, for those seeking to generate good risk-adjusted returns. Additionally, you will arrange to fund the account with a sum appropriate for you and your long-term financial objectives. Once that is taken care of, you can immediately start lending money to deserving borrowers.

Naturally, at good online P2P lending services, those looking for finance are assessed following well-honed underwriting criteria, helping to ensure that they are given interest rates and other suitable terms. In addition, experienced lenders like to deal with service providers of institutional caliber and, more importantly, have stakes in the outcome, so they are concerned with the caliber of the loans offered. It could be essential to work with a platform with a well-managed default-control framework for those few times when borrowers fail to uphold their obligations.

Transparency for a mutually beneficial partnership

Peer-to-peer lending also succeeds because it provides transparency that promotes a better experience for investors and borrowers, particularly in an area like Europe where traditional operators have not been particularly open about disclosing costs or dangers. Moreover, reaching a mutually beneficial agreement is more manageable when both parties know what to expect and access all the information they need.

The consequence is not unexpected, even in those challenging but foreseeable situations where borrowers fall short of their repayment responsibilities. What happens next, for instance, has been spelled out for many P2P platforms. This helps to ensure that when you invest in a peer-to-peer network, you are not assuming the kinds of risks that experienced investors try to avoid, together with a well-managed default-control mechanism. Instead, a financial partner who has little to gain from taking advantage of its consumers keeps you informed.

There are variations among the different peer-to-peer lending platforms, as there are in any industry. It is critical to consider technical and underwriting capabilities, customer service and support, flexibility, and ease of use, as well as other elements that can distinguish between a bad relationship and one built to last. It makes sense to understand what you are getting into, whether you are a borrower or a lender, a person or a corporation, big or small.

Things to check before you engage in P2P lending

Both investors and borrowers need to check a few facts before they start:

- Check that the platform’s license and registration are valid and updated.

- Check the platform’s history or association with owners.

- Compare investment plans before investing your money.

- Check the default clauses. Will the platform compensate for your lost investment if the borrower defaults?

- Borrowers should also perform due diligence before availing of any unsecured loan through these platforms.

- Borrowers should compare interest rates on different platforms and packages.

- Borrowers should also read the clause if any debt covenants are attached to the agreement.

- Both investors and borrowers should also check the fee and charges from the P2P lending platform.

For investors, the risks associated with P2P lending platforms are higher than a secured investment. For borrowers, although the lending restrictions are softer than banks, they still count. Their interest rate will go higher with a lower credit score, the same old story as with the banks. Economic recessions and joblessness in the market often create such scenarios.

Therefore, P2P lending platforms are an excellent alternative finance source for investors and borrowers alike. The evolution of the internet and e-commerce has also facilitated these online P2P lending platforms, making collaboration for investors and borrowers a lot easier. Despite initial hurdles, the P2P lending platforms are simultaneously gaining popularity as alternative investment and loan facilitators.

In a nutshell

Peer-to-Peer lending, or P2P lending, is where individuals lend money to other individuals or businesses. Wealthy individuals looking for investment and needy individuals looking for alternative financing are pooled together on a single platform. These platforms work as a middleman or facilitator but only to a limited extent. P2P lending platforms often work online; in fact, the rise of P2P platforms has primarily been possible due to online networks.

To put it another way, you should not only see P2P lending as a new funding source. As a sophisticated yet simple method for achieving long-term financial security, you should instead perceive it for what it is. This cutting-edge internet investing option offers much, whatever your situation or investment capacity.

With that in mind, one thing stands out as being obvious. P2P lending is a great place to start if you’re looking for an appealing alternative to traditional investing. So isn’t it time you joined the action?