You should be familiar with what a good credit score parameter is if you have ever considered getting a mortgage, educational, or personal loan. That score determines whether you will get the loan or not.

How is a credit score important?

To better understand its importance, you need to know the definition and use of credit score first. A credit score is a three-digit score that depicts your credit worthiness. Lenders use that rating to decide if they should grant you credit or not.

The usual practice for the latter is to use credit reporting agencies’ services to evaluate a particular person’s credit information and determine a person’s credit score. Those agencies base their observations depending on the following factors:

- Number of credit applications;

- Amount of outstanding debts;

- Any late payments;

- Type of loans or credit cards that have been approved;

- The total quantity of loans available;

- Time elapsed with an open credit;

- Debts sent to collections or foreclosure, if any.

Based on the above, it is easy to conclude that your credit score is representative of your financial profile, pointing to whether you are a lucrative debtor or not.

Why is having a high score noteworthy?

As mentioned, the credit score is a financial reference. When you want to take a new loan or get a line of credit, the lender checks your rating to decide whether to give you a loan.

If your credit score is high, the lender will grant you the loan with the best conditions – such as low interest and annual percentage rate. If your credit score is down, on the other hand, you might still get a loan but with less favorable conditions. In case your credit score is too low, there is a chance that the lender will not grant you the loan you have requested at all.

What is the ideal credit score rating?

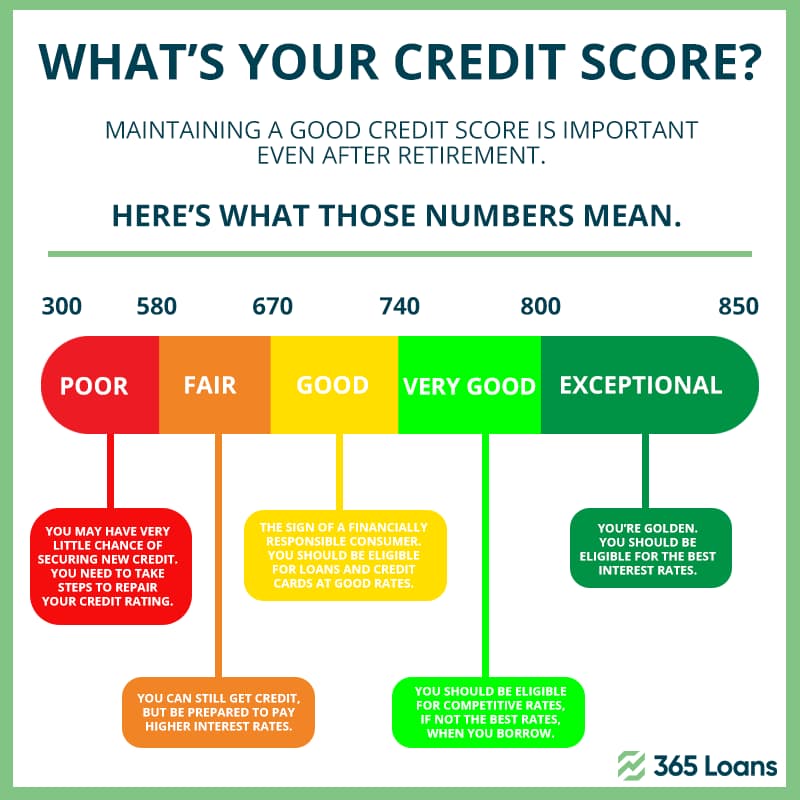

The most common credit score uses rating points from 300 to 850 to evaluate financial background. Although different credit reporting agencies work with varying scoring models, common sense is the same in all cases. Hence the higher your score, the better.

365loans has taken the scoring models of two major credit bureaus to guide you in the more or less overlapping classifications.

Scores based on FICO:

| Score Type | FICO Score |

|---|---|

| Poor | 300 – 579 |

| Enough | 580 – 669 |

| Good | 670 – 739 |

| Very good | 740 – 799 |

| Excellent | 800 – 850 |

We also have the credit score from the VantageScore agency, which determines the following:

| Score Type | VS Score |

|---|---|

| Poor | 300 – 499 |

| Little enough | 500 – 600 |

| Enough | 601 – 660 |

| Good | 661 – 780 |

| Excellent | 781 – 850 |

How can I improve my rating?

If your credit score is within the values we mentioned, You do not have to worry. However, if it is too low, you need to work on improving it if you want to be eligible for a loan.

Here are some ways you can do it:

- Pay your loan or credit card installments on time. Always stay up-to-date and do not let debt fall behind for any reason because your score will go down in contrast to the rising interest.

- Reduce the use of credits. We recommend you aim for below 10% in credit debt.

- Pay your bills on time. As usual, you need to pay your bills on time, at least for six consecutive months, to see the difference in your credit score.