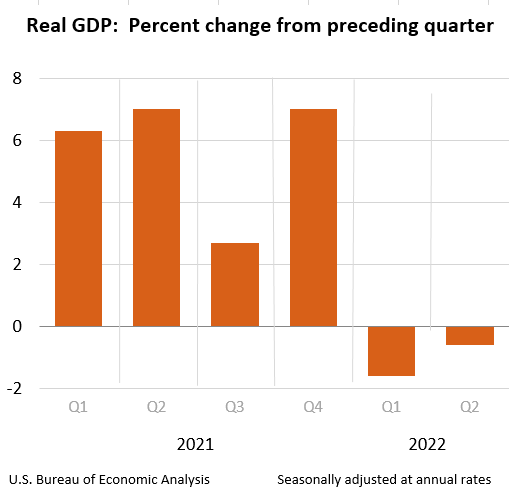

For many Americans, the recession is the most pressing issue. However, how can we tell if we are in one? Technically, a country enters a recession when its gross domestic product, which measures the total value of all goods and services produced over a given period, decreases for two consecutive quarters.

Results released last week confirmed this:

Even while all indications lead to a recession, the National Bureau of Economic Research, which makes this determination in the US, has not yet declared one. But it seems like a semantics contest whether we can or cannot term this period a recession.

Ultimately, average people are struggling as prices keep rising, borrowing costs climb, and job losses spread across all nations. Here are some recent queries regarding how to plan, save, invest, and make wise financial decisions in these unsettling times.

What might a recession bring?

Reviewing recession results in the past is usually beneficial so that we can control our expectations. Although the duration, severity, and effects of each recession vary, we often experience an increase in layoffs and unemployment during economic downturns. Because banks are concerned about default rates, access to the credit market could become more complicated, and they might be reluctant to make loans.

The cost of borrowing will rise much more as the Federal Reserve keeps raising rates to try to control inflation, for example, on mortgages, auto loans, and business loans. Therefore, it will be more difficult for households to borrow money or pay off debt even if they are approved for a loan or credit card because the interest rate would be higher than it was the previous year. In the housing market, where the average rate on a 30-year fixed mortgage recently approached over 6%, the highest level since 2009, we can already see this.

Prices for products and services fall during recessions as rates rise and inflation slows, and our personal savings rates may rise, but this all depends on the labor market and wages. As the newly unemployed frequently look for ways to make a small business idea into reality, we might also observe an increase in entrepreneurship, similar to what we witnessed in 2009 during the Great Recession.

Will layoffs increase in frequency?

The job market may seem to be the only solid aspect of the economy, with the unemployment rate at 3.6%. But given that businesses are already starting to announce layoffs in response to the current economic headwinds, which include inflation, rising interest rates, and falling consumer demand, that is probably only a transitory situation.

A website that records employment losses at internet firms, Layoffs.fyi, reports that in the second quarter of 2022, there were about 37,000 layoffs from startups.

During the Great Recession, unemployment peaked at 10%, and it took people who were unemployed an average of eight to nine months to find new employment. Therefore, if you believe there is a shortage, now might be the time to ask yourself what should be included in your emergency fund. If you won’t be able to save enough money to last at least six to nine months—which is complicated for most people—look into ways to increase your savings rate by reducing consumption or earning additional income. Additionally, this is an excellent time to update your résumé and make contact with key figures in your professional and personal network.

Investigate alternative revenue sources if you are self-employed and concerned about a potential downturn in your business or a loss of clientele. Attempt to increase your cash on hand as well. Again, if past recessions have taught us anything, it is that having cash during a difficult period unlocks options and gives you more control.

Will the interest rates on my debts and loans increase?

Adjustable interest rates are expected to rise as the Federal Reserve keeps raising interest rates to try to stop inflation. This will push up credit card and loan APRs and increase monthly payments. Inquire about low-interest credit possibilities with your lenders and card companies.

Some financial organizations have not lent as frequently during recessions as they did during “normal” times. This can be problematic if you require a mortgage to purchase a home or if your business depends on credit to grow. It’s time to pay special attention to your credit score because it plays a significant role in the choice a bank makes. Your chances of qualifying and receiving the best rates increase with your score.

Bottom line

It is critical to remember that recessions are a typical feature of the economic cycle.

Long-term financial goals will inevitably go through some hard times. Still, the world has seen roughly a dozen recessions since World War II, usually ending within a year or less. On the other hand, periods of expansion and growth are more common and endure for a more extended period. So focus on that instead of worrying about potential implications.