Before applying for a mortgage loan, you need to know what it is and how it works. A mortgage is a type of loan you can get from financial institutions. Like other personal loans, a mortgage comes with an interest rate and extra commissions depending on the bank from which you are getting the loan. As a borrower, you will have to pay the loan with the additional charges in monthly installments.

A mortgage is a type of secure loan, meaning that to get it, you need to put collateral. Usually, the collateral is a flat or a house. The property serves as a payment guarantee. Meaning, that once you get a loan, if you will not pay it back entirely, you will lose right on the property you mortgaged.

How does a mortgage work?

To understand how a mortgage works, you need to consider these three factors: collateral, interest, and payment terms. The collateral is the guarantee for the payment and can be any of your properties – an apartment, a house, or business premises.

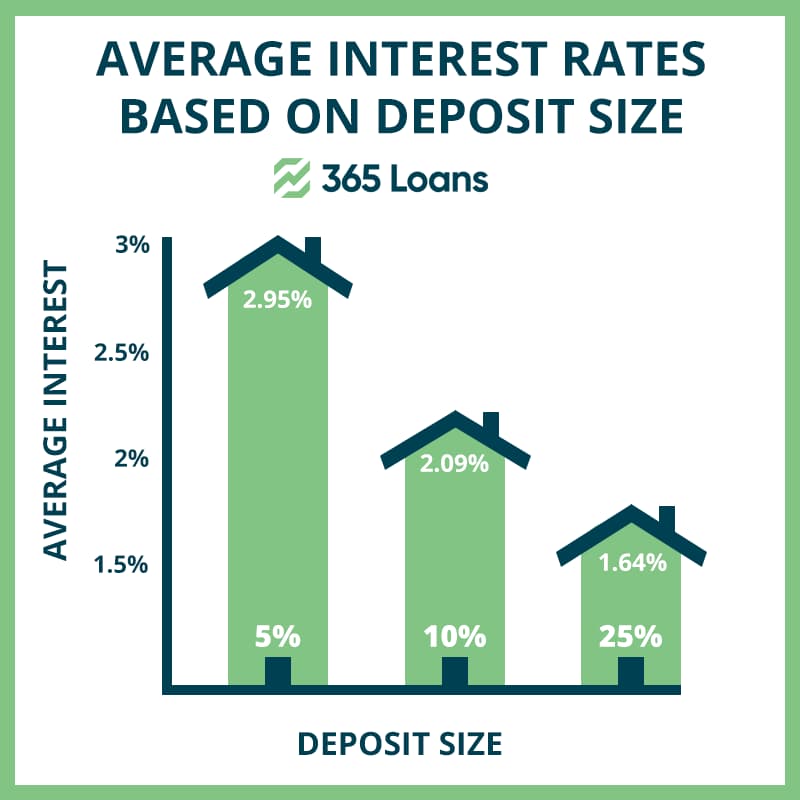

The mortgage loan comes with an interest rate. That is the surcharge to the initial money you get as a loan that generates profit for the bank. The interest rate on your mortgage loan depends on many factors, such as the country you live in, the bank you are getting the loan from, and your credit score. When you get a mortgage loan, you agree to pay back the loan amount plus the interest rate.

If you cannot pay the money back, the bank will get ownership of it.

Payment terms of mortgage loans can be different too. You can take a loan for as low as three years up to as many as 30 years. However, the longer your payment plan is, the more you will pay in interest rate. Still, in all cases, you will be repaying the amount owed in monthly installments.

Types of home loans

There is a variety of mortgage loans that can be described as follows:

- Fixed mortgage. This loan assures that your interest will not change during the payment period, so it will not affect the monthly rate.

- Variable mortgage. For this type of mortgage, interest can go up or down from one moment to the next. It all depends on the Euribor reference index, which is the one that indicates the interest percentage.

- Mixed mortgage. It combines the two previous types of mortgage credit, functioning as a fixed mortgage for the first period and then switching to a variable mortgage mode.

You might also want to check out: Choosing between Variable-Rate and Fixed-Rate Mortgage

Benefits of a mortgage

One of the advantages of mortgage loans is that you have an extended period to return the money you requested. In addition, in most cases, you can cancel any time you have the total money to pay back the loan in full as long as you notify the Property Registry and the bank that the property no longer has credited debts.

Another benefit of having a mortgage is the extremely low installments, unlike ordinary loans.