When you first purchase your house, you might imagine that it would be worth more when you sell it. Of course, you must be overjoyed by the idea of living in a place that can also make money for you someday. However, is there a way to access that cash without selling? You may, and it might be a wise financial choice in certain situations.

Maybe money is tight for you. Perhaps you don’t feel like you have enough money for home improvements, college costs, or other significant investments, and you’re hoping you may use your house as collateral to help pay for them.

In the lines that follow, we’ll examine the differences between the two options and determine which one is better for you.

What is equity in a home?

There are two ways to borrow money using the equity in your home, both of which are frequently referred to as “second mortgages.”

- A home equity loan; and

- A home equity line of credit (HELOC).

While each mortgage refinance option has advantages and disadvantages of its own, you will probably discover that one of the choices better suits your needs and can enable you to pay for something significant without getting into too much debt.

This is frequently an excellent approach to go about getting the money you need because these loans typically have cheaper interest rates than either a personal loan or a credit card. You can even deduct it from your taxes if you intend to use this money to pay for house upgrades. The main risk associated with this loan is that the lender may foreclose on your home if you are unable to make your payments on time. However, if you choose wisely and approach your repayment with intention, this could be a fantastic option for you.

Advantages and Disadvantages of a Home Equity Loan

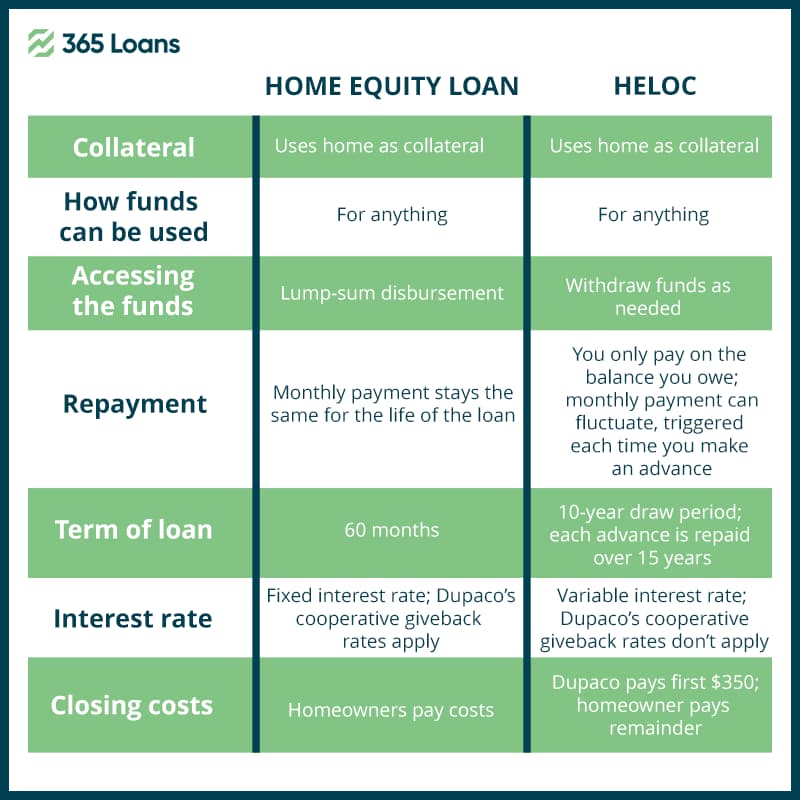

If you are approved for a home equity loan, you may get a lump sum payment right away. However, this means that if you require a significant sum of money all at once, you must first be accepted for the entire loan amount at this time and then pay a set rate for the duration of the loan.

There are a few advantages to choosing a home equity loan, but perhaps the most significant one is that you’ll pay it back according to a set monthly plan. This makes budgeting considerably simpler and ensures that you are never caught off guard by the amount of money you must pay each month. The loan you qualify for depends on a variety of factors, including the value of your home, your credit score, and others.

With a home equity loan, you run the danger of losing your house, but you can take a calculated approach to repayment so that you can deduct the loan from your taxes and ensure that your income will be sufficient to meet the monthly payments as soon as you sign the contract. Because of this, a home equity loan is frequently regarded as a secure alternative that will enable you to borrow the amount you require without running the risk of going beyond in the months that follow.

Advantages and Disadvantages of a HELOC

A home equity line of credit is a revolving line of credit that you are free to use whenever you need it. Similar to a credit card, it allows you to apply for a variable line of credit and only charges interest on the amount you actually borrow each month. This implies that you may periodically withdraw cash to pay contractors if you’re utilizing the funds for house improvements.

However, it also means that, unlike with a home equity loan, you won’t be able to budget how much you will have to pay each month. When you utilize it, your monthly payment will increase.

With this option, it is not unusual for lenders to grant you a 10-year draw term during which you can keep taking money out, but you will have more time to pay off the interest and any outstanding balance once the draw period is over. So this option gives a lot of flexibility for individuals who do not require a sizable upfront payment and do not mind the unpredictable nature of month-to-month pricing increases.

Which is better: a HELOC or a home equity loan?

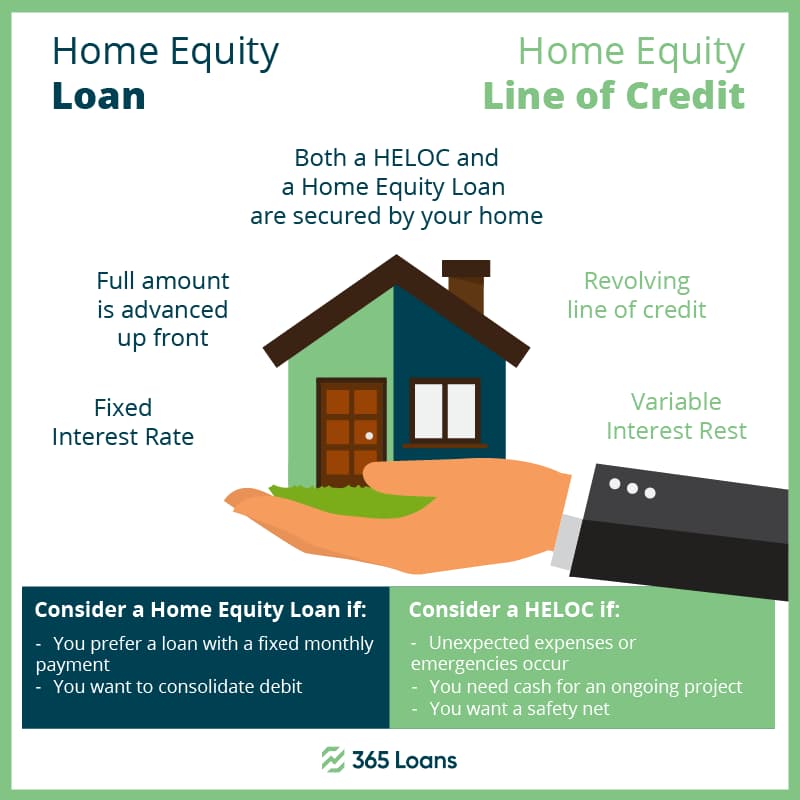

You are probably attempting to determine at this point which type of mortgage is best for you. Take these keynotes into your consideration:

- Home equity loans offer greater reliability and are more flexible than HELOCs.

- HELOCs are generally a better choice for you if you want to reduce interest.

Regardless of what you may be thinking right now, make sure you speak with a reputable lender and comprehend everything that may affect your choice.