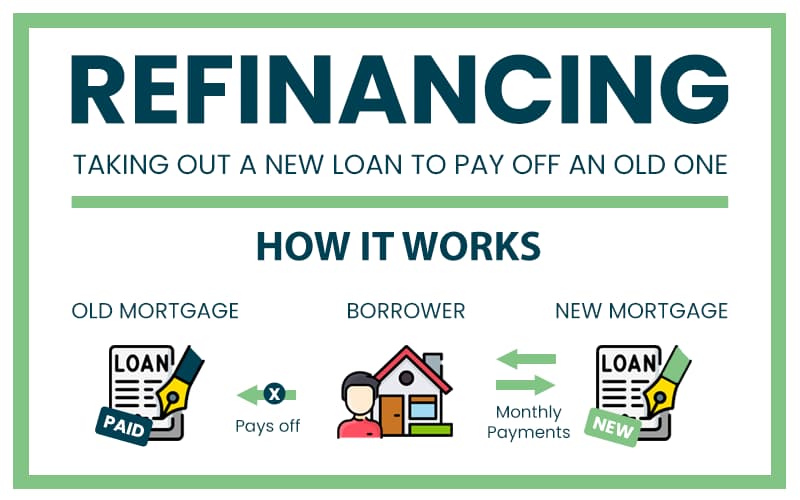

At least once in their lives, the majority of Americans go with mortgage refinance for their homes. Is this considered good or financially bad? It is neither by default.

About 40 years ago, refinancing your mortgage was almost unheard-of-matter. However, over time, mortgage lending has seen significant change, and nowadays, this is a substantial factor in the life of most people. People want to use part of the phantom equity in their homes that they have realized increased in value – at least on paper – to pay off other debts, purchase items like luxury cars, or carry out home repair projects.

But should you refinance your house?

Within the following lines, you will find 7 advantages and 6 disadvantages of mortgage refinancing.

What are the advantages of refinancing your mortgage?

They are rather obvious:

- Refi PRO #1: You might pay less each month.

Presuming you are locking into a cheaper fixed-rate loan and not a variable-rate note, your monthly payment may be lower, and you will pay considerably less interest over the life of the loan. That is if you are simply refinancing at a lower rate and not taking much cash out (or any cash, for that matter). Your finances can be a little simpler with a cheaper monthly payment, and you will have more money for savings. Unfortunately, most people choose to cash out instead of doing this, which results in a similar or even greater monthly payment.

- Refi PRO #2: You can withdraw money.

Whether this is an actual “benefit” is debatable in the same way as coming to a place where you can get a payday loan, and having that fan of $20 notes is an advantage (as often advertised). Every loan has to be repaid, plus interest. So, you do end up with a lot of money, but cheap money typically gets spent carelessly, leaving you with debt. Keep in mind that your net worth is currently less than it was.

- Refi PRO #3: Mortgage insurance can be avoided.

Mortgage insurance, which is often necessary for first-time purchasers, can be avoided in some refis if the property’s appraised value has increased sufficiently and the debt-to-equity ratio has decreased to that amount. This could result in a $100 or so monthly payment reduction. Of course, if you can demonstrate to your current lender that the home’s value has improved to the point that you no longer need the insurance, you may be able to ask them to stop requiring mortgage insurance.

- Refi PRO #4: Debt consolidation.

If you have credit card debt issues, you can take a “breather” and restructure your loans with a cash-out refi. The issue is that you take on short-term debts for expenses like a lunch you blew last week and finance them over 30 years. This might be a way to get one’s finances back on track. However, the problem is that most people think of themselves as financial whizzes after completing a refinancing and continue to accrue credit card debt.

- Refi PRO #5: You may shorten your loan term.

For example, some people utilize a refi as an opportunity to move to a loan with a shorter term. An interest rate on a loan for 20 or 15 years will probably be cheaper than one for 30 years. If interest rates have decreased recently, you may be able to refinance and get a loan with a shorter term and a cheaper monthly payment! In five or 10 years less than you anticipated, you can become your property’s sole owner. Sadly, hardly any do this; instead, they choose a brand-new 30-year loan.

- Refi PRO #6: It is preferable to a HELOC or second mortgage.

This is one of those cases where it is preferable to poke a knitting needle in your eye than your heart. It is probably more effective, and you will receive a cheaper rate with a cash-out refi than a second mortgage or a HELOC if you want to “cash out” of your home. The interest rates on second notes are often higher because they are second in line to be repaid in the case of foreclosure. Having stated that, it is always preferable to have less debt than more debt.

- Refi PRO #7: Turning non-deductible debt into a deductible.

An argument put out by mortgage brokers is that if you refinance with a cash-out and pay off previous debts, the interest on the new debt is tax deductible. While true, this argument holds significant condition flaws in any case.

To begin with, a purchase money mortgage is the only type of loan for which you can write off the interest. As a result, hypothetically, if you spend $200,000 on a property and finance it for $200,000, you can deduct interest on the entire $200,000. However, if you do a mortgage for $250,000, you can only claim the interest on the first $200,000. Still, you cannot become wealthy by deductions.

Take advantage of any tax credits or deductions you are eligible for, but consider it makes no sense to take on greater debt only to claim tax deductions. It might make such debt appear bearable, but having less debt is still preferable.

What are the disadvantages of mortgage refinancing?

With the above benefits promoted by mortgage lenders, the home equity line of credit (HELOC) and the cash-out refi were born. As a result, people started spiraling down the funnel without asking themselves at what price. So let us review the disadvantages of mortgage refinancing.

There are numerous dangers, and in 2009, we witnessed directly how harmful refinancing can be. These are a few of the risks you might run into:

- Refi CON #1: Your house’s worth could decrease.

As was the case in 1989 and again in 2009, 20 years later, property values can peak, and bubbles can burst. Amid a bubble, it is possible to refinance your property based on an exaggerated assessment value, only to find out five or ten years later that your house is no longer worth what you owe on the loan. As a result, if you lose your job (for example, during a recession), you cannot sell the house for what is owed and wind up in foreclosure.

In 2009, we witnessed much screaming and yelling as folks bemoaned how unfair it was that they were “losing their home” due to foreclosure. But if you read between the lines, you will discover that many of these people who complained that life was “unfair” had borrowed money from their homes to pay for expensive automobiles, trips, and credit card debt repayment. In the best-case scenario, they invested in other real estates.

Some people borrow money to remodel their homes. This is all good, but remember that even the best remodeling projects only pay back fifty cents to a dollar at most. Therefore, if you borrow thirty thousand to renovate your kitchen, your house might only gain fifteen grand in value. So no matter how you cut it, you end yourself in debt and behind.

- Refi CON #2: You increase the interest you pay.

Any mortgage’s initial few years are essentially spent paying interest only. You regrettably discover that the mortgage business received $1000 from you, of which $950 was interest and only $50 was principal.

As a result, your neighbor, who defies the trend to become a “serial refinancer,” ends up with a free and clear title to his dreary old property faster than you do.

- Refi CON #3: The debt timer resets.

As mentioned above, most folks who refinance choose a new 30-year note.

If you can afford to go for 15 or 20 years but get advice from your mortgage broker about taking a 30-year note and making extra payments once a year – avoid it. As rational humans, we often choose to buy beer with the additional payment money, kissing goodbye the early retirement.

Resetting the debt clock has several negative impacts, including the prospect of eternal debt and increased interest payments over time.

- Refi CON #4: Permanent debt.

Following the thoughts on the previous disadvantage, you risk getting permanently in debt. Similar to how individuals rationalize a drug habit, many people try to justify this.

The issue is that you must eventually repay debt, yet many people fail to consider this.

It is similar to how many young people justify their student loan debt by acting as though living a high life while in college was inevitable and that taking out loans was a “mortgage on your career.” And the people who offer these excuses frequently wear luxury clothing and own the newest $1,000 iPhone. They are taking on increasing amounts of debt to purchase trinkets. They are hopelessly in debt when they retire and have no other option except to file for bankruptcy to pay it off (which does not discharge student loan debt)—quite a way to retire.

- Refi CON #5: Remember the costs!

Loan origination fees, mortgage points, mortgage insurance, document preparation fees, and other expenses can all be added on. It pays to look closely at them and negotiate a lower price because lenders frequently raise their fees and won’t lower them unless you threaten to move your business elsewhere.

The general guideline for refinancing is that it is probably worthwhile to do so if the money you save more than covers the transaction fees in a year or two. Unfortunately, as was already mentioned, most people refinance to spend money they do not have, not save it. As a result, their monthly payment increases rather than decreases. As a result, in addition to the cash-out, the loan total is increased by the lender’s fees, frequently in the thousands of dollars.

Shopping around also pays off.

- Refi CON #6: You lose net worth.

The majority of individuals consider refinancing a mortgage as monthly payments.

So if my monthly income is $X and my monthly expenses are $Y, and I make sure that X>Y, then I am doing okay, right?

Not always.

You see, there is your whole net worth to take into account, and most people are unaware of their net worth. Instead of thinking in terms of monthly payments, it makes sense to consider total transaction costs.

You are compelled to do this if you are debt-free and reliant solely on your savings. The monthly payment attitude is quite alluring, though, when you have little money, a lot of debt, and a consistent paycheck from a “career.”

Should you refinance your house?

It is highly fact-specific and based on your unique situation piece of advice.

The optimal scenario to refinance your mortgage is if you can reduce your interest rate by 0.50 to 0.75 percentage points and intend to live in your property long enough to repay the closing costs. If not, however, you might be better off borrowing as little money as you can because you must repay borrowed money.